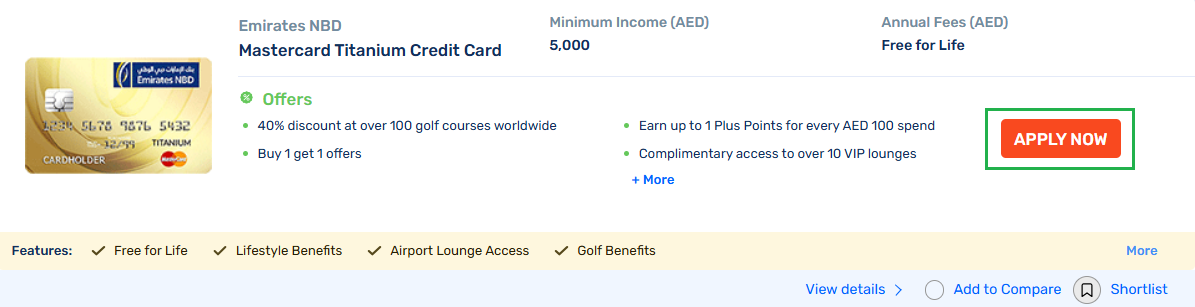

Emirates NBD Mastercard Titanium Credit Card

Emirates NBD Mastercard Titanium card is among the top cards in the UAE. Although having minimal eligibility requirements in terms of salary and more, this card still lets you enjoy access to a range of travel and lifestyle benefits. In fact, as a free for life credit card, it makes your spends even ...read more

Emirates NBD Mastercard Titanium Credit Card Benefits

Tabled below are the Emirates NBD Mastercard Titanium credit card benefits in the UAE —

| Benefit Type | Details |

|---|---|

| Travel |

|

| Lifestyle |

|

| Reward Points |

|

NBD Mastercard Titanium Card — Know Your Eligibility

To get an ENBD Mastercard Titanium card for yourself, you need to meet the following eligibility requirements —

| Eligibility Type | Criteria |

|---|---|

| Age | 21 years and above |

| Salary | AED 5,000 or more |

| Nationality | UAE national or expatriate |

| Employment Status | Salaried or self-employed |

| Credit Score | As per the bank’s decision |

Emirates NBD Mastercard Titanium Credit Card — Documents Checklist

Keep the following documents ready when applying for this emirates nbd credit card as per your applicant category —

| For Salaried Individuals | For Self-employed Individuals |

|---|---|

| ✅Emirates ID ✅Passport ✅Residence Visa (For expat applicants) ✅Salary Proof- Salary Slip/ Salary Certificate ✅Latest 3-6 Months’ Personal Bank Statement |

✅Emirates ID ✅Passport ✅Residence Visa (For expat applicants) ✅Trade Licence and MOA ✅Latest 3-6 Months’ Company Bank Statement |

Emirates NBD Mastercard Titanium Card — Fees & Charges

Refer to the major fees and charges linked to the Titanium Mastercard —

| Fees Type | Charges |

|---|---|

| Annual Fee | Free for Life |

| Late Payment Fee | AED 241.5 Per Month |

| Overlimit Fee | AED 292.95 Per Month |

| Retail Interest | 3.25% Per Month |

| Minimum Payment | The higher of

|

Frequently Asked Questions

Ans: Yes, you are eligible as the card’s minimum salary criteria is AED 5,000.

Ans: Yes, the card lets you enjoy complimentary access to more than 10 VIP airport lounges.

Ans: This is a free-for-life card, meaning there is no annual fee.

More From Credit Cards

- Recent Articles

- Popular Articles