- What Does a 620 Credit Score Mean?

- How to Improve Your Credit Score?

- What Can I Get With a 620 Credit Score?

- Can You Get Credit Cards with a 620 Credit Score?

- Can You Get a Personal Loan with a 620 Credit Score?

- Can You Get Home Loans for a 620 Credit Score?

- Can You Get an Auto Loan with a 620 Credit Score?

- Can You Get Insurance Plans with a 620 Credit Score?

What Does a 620 Credit Score Stand For?

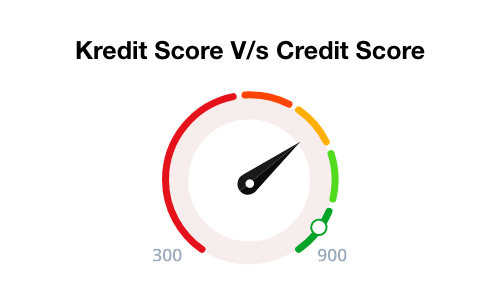

Credit score, a 3-digit number that ranges from 300 to 900, summarises your creditworthiness as a borrower. The credit rating bureaU, which in the case of UAE is ACEB (Al Etihad Credit Bureau), is in charge of assigning this AECB Credit Score. They go through your recent credit behaviour and, after a few calculations, come down to a rating.

The significance of this score is that the financial institutions use it as a reference point to judge you as a borrower. They decide whether to extend credit or not. So, it is essential for you to be aware of it.

Keep reading to know what a 620 credit score stands for.

What Does a 620 Credit Score Mean?

A prominent question that arises here is, is 620 a good credit score? Well, it is not exactly. This is a poor credit score that is often represented with 2 stars. So, it is ideal to say that there is significant room for improvement.

Furthermore, having a credit score as low as this can become a disadvantage when applying for a loan. In such cases, you may need to agree to unfavourable loan terms that will increase your financial burden as a whole.

So, what are the reasons behind this scenario?

Factors That Affect Credit Score Negatively

Here are some reasons that can affect your credit score negatively –

Failing to Pay the Dues on Time

One of the main reasons behind the depletion of your credit score is your failure to pay the dues on time. This will include your credit card bill, current EMIs and other debts. Failing to pay them can put a bad mark on your credit score.

Failing to Maintain the Credit Utilisation Ratio

Another reason behind the lowering of credit score is your failure to maintain the desired credit utilisation ratio. If you keep on maximising your credit card limit and the overdraft account, then it creates a negative perception of you as a borrower. It presents you as an unreliable one, which is never ideal.

Keep Applying for Credits Regularly

When you apply for a loan, the financial institution places a verification request with the local credit bureau. These requests are known as hard queries, and they affect your credit score negatively. So, if you keep applying for loans, multiple hard queries will bring down your score.

Failing to Maintain a Healthy Mix of Credit

Failing to maintain a balanced mix of secured and unsecured loans can also affect your credit score. The reason is that taking up different credit options and paying them off successfully makes the impression of an accountable borrower.

Closing Old Credit Cards

Closing old credit cards can also lower your credit score. Since these payment cards hold a long transaction and repayment history, closing them will delete that from the system. Resultantly, you will lose a few points on your credit score.

How to Improve Your Credit Score?

Here are some tips on improving your credit score –

- Pay your bills on time

- Maintain your credit utilisation ratio

- Keep your credit portfolio diversified

- Apply for a single loan at a time

- Resolve the discrepancies in your credit score

What Can I Get With a 620 Credit Score?

Increasing the credit score is not an overnight task, but your financial emergencies will also not wait till you sort this out. Therefore, it is better to be aware of the financial services you can access with it. In this regard, the following section can help you better understand answers to some common questions.

Can You Get Credit Cards with a 620 Credit Score?

Yes, you can get credit cards with a credit score of 620. However, there will be limitations in the form of reduced credit limits, stringent repayment terms, and others. Also, you may not be able to get cards with lucrative benefits.

Can You Get a Personal Loan with a 620 Credit Score?

Yes, you can get personal loans for a 620 credit score. However, the loan amount and other terms like interest rate and tenure will not always be favourable to you. Nevertheless, it is ideal for checking with the financial institution before moving ahead.

Can You Get Home Loans for a 620 Credit Score?

Yes, you will be able to secure a housing credit with a 620 credit score. But, you need to be aware of the fact that the terms may not be in your favour. You may not get the loan amount you need, pay a higher interest rate, and may not enjoy certain additional benefits. Furthermore, you may have to make a substantial down payment.

Can You Get an Auto Loan with a 620 Credit Score?

Yes, you can get an auto loan with this credit score. But, as mentioned above, you may have to agree to not so preferred loan terms.

Can You Get Insurance Plans with a 620 Credit Score?

Yes, you can get an insurance policy with this credit score. This includes every type, i.e. health, life and general.

The 620 credit score is not a very high one, and there is a lot of room for improvement. So, it is on you to make sure that you are using the aforementioned tips and suggestions to achieve a higher score in the future.

Frequently Asked Questions

Financial institutions typically consider a credit score above 700 an ideal credit score.

It is highly unlikely that you will be able to increase your credit score within a month. You need to stay on a strict financial plan to get it up considerably.

There are different ways to get a loan with a low credit score. But, the easiest one is getting a co-borrower with a high credit score.

In cases like these, you need to get in touch with financial institutions and explain the situation. You may get the required financial assistance but usually against unfavourable terms.

| Credit Score for different types of Loan | ||

|---|---|---|

| Credit Score for Personal Loan | Credit Score for House Loan | Credit Score for Car loan |

More From Credit Score

- Recent Articles

- Popular Articles